Bank Pulse: Bank lending rates expected to rise this year

As the European Central Bank takes its time phasing out asset purchases and isn’t expected to start raising rates until next year, market rates have risen. Bund and 10-year swap rates ended 2021 up around 50 basis points. As a result, the Eurozone is probably very close to the absolute bottom of bank interest rates as well. However, this is not yet visible in the rates for bank loans to businesses. Eurozone average corporate bank rates continued to decline in November (the latest month for which data is available) to 1.38%, 11bp lower than at the start of 2021. Still, the trough in rate is most visible in the rates charged to households.

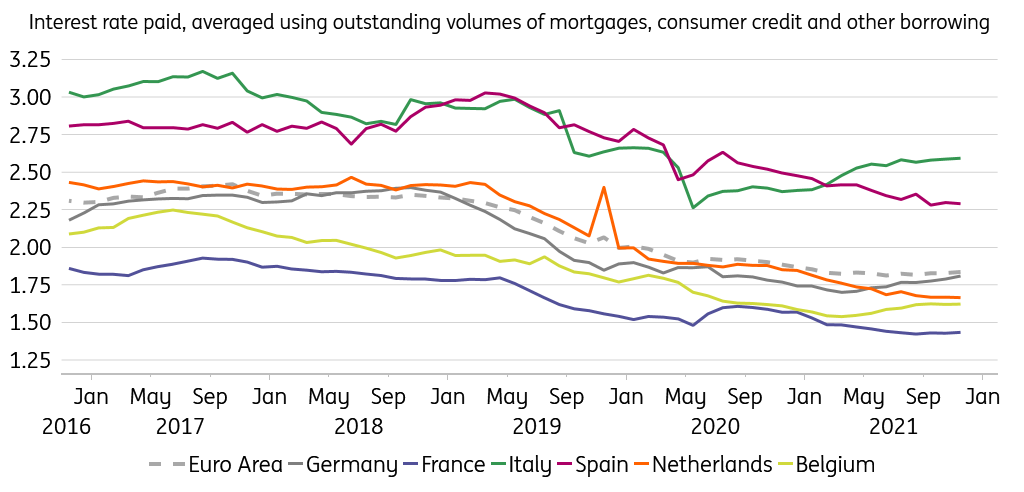

The average rate charged by eurozone banks to households hit a historic low of 1.81% in June last year, and has been rising slightly ever since. The November reading shows an average rate of 1.84%. Admittedly, it even takes two decimal places to register this increase. But digging a little deeper, it appears that this small upward drift across the euro zone is mainly due to slightly more pronounced increases in mortgage rates in Germany and Italy. Average German and Italian mortgage rates increased by 17 bps and 19 bps respectively in 2021 (see chart).

Average household borrowing rates (%)

Zooming in even further, in Germany most of the increase in mortgage rates occurred in the 10+ segment. In Italy, rates have increased the most on the 5-10 year segment, but not (yet) on the popular 10+ year segment. The upward trend in Belgian bank rates was driven as much by mortgage rates as by a sustained upward drift in consumer credit rates, after a sharp drop in May 2020. Mortgage rates in other major euro area economies continued to fall in 2021, although they tended to stabilize towards the end of 2021. Bank rates on consumer credit and other types of credit, although volatile, tended to move sideways in 2021 (with the notable exception of Belgium).

Going forward, the announced slowdown in ECB asset purchases and the anticipation of ECB rate hikes next year should work their way into the upward pressure on bank rates. But the upward pressure also comes from another side. Several national supervisors have announced increases in countercyclical buffers (CCyB), mainly to cool buoyant real estate markets. The German Bafin intends to set a countercyclical cushion of 0.75% for all domestic exposures and a cushion of 2.0% specifically for assets covered by real estate by February 2023. The French High Council for Financial Stability (HCSF) and the Irish central bank have not previously raised the CCyB, but both have indicated they plan to do so this year if the economic recovery continues as expected. Meanwhile, the Dutch central bank has launched a consultation on its intention to raise the CCyB to 2.0% throughout the cycle. Any increase in the countercyclical buffer would put upward pressure on bank rates, particularly mortgage rates. To be clear, this would be a feature of macroprudential policy, not a bug. And while countercyclical buffer increases typically don’t take effect immediately after announcement, banks can expect to update their prices quickly. After all, CCyB applies to all outstanding loans, not just new production after CCyB comes into force.

Source: ING

Comments are closed.